Forex stands for foreign exchange market and as the name tells it is exchanged market. It is a decentralised market for the trading of currencies. The main members of this are big and famous banks and financial centres. Forex trading helps in finding the relative values of the different countries. The most liquid financial market in the world is foreign exchange market. One of the biggest trading markets is the United Kingdom.

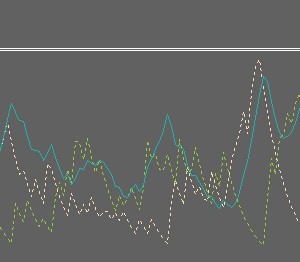

Now let’s talk directional movement index or DRI. Directional indicator index was first created by J.Welles Wilder in 1978. This person also bought popular relative strength index. It is defined as momentum indicator which is used to determine the presence of a trend and trend strength. It helps in calculating the dynamic average of varieties of expression over a given period of time. It gives a proper difference between strong and weak, telling a trader to enter in the strongest trend. It can be recognised by two lines namely as positive directional movement index and negative movement directional index. These lines tell about the power of buying and selling pressure in the forex market. Directional movement index can also be used with another indicator to have a clear view of the forex market. Directional movement index can also be used in stock trading or future trading. There are a lot of graphs on the internet which shows the two lines and easily be seeing those graphs you will get to know about the stronger and weaker trends. When there is a change in the trend of the price, then the graph DMI lines pivots. The structural pivots must correlate with the DMI pivots. The +DMI pivot is high when the price pivot is high and -DMI pivot is low when the price pivot is low. Whenever you see any divergence in the graph then you should understand there is some risk coming on the way.

One should understand the concept of the DRI properly if they want to make the profit in the market or trade. There are a lot of factors which affects the DRI characteristics, so you should be careful while trading in the foreign exchange market. DMI contains a lot of good information and strategies which can help you in gaining some good amount of profits in the market. All you need is some time, some patience and a very powerful knowledge about the foreign exchange market and you will success and money waiting for you at your doorstep.