The easiest way to obtain Fibonacci sequence is by adding the final 2 numbers to get the next digit. The initial 2 numbers are 0,1. You simply add the previous 2 numbers for obtaining the next figure.

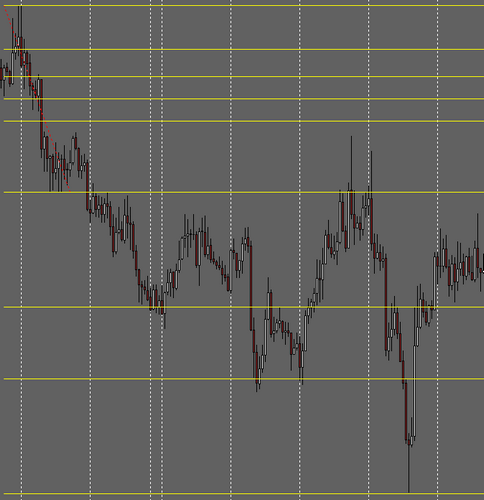

Whenever there’s a trend, the price action is slowly going lower or higher. If there’s an uptrend, then the price action can make higher lows & higher highs. Whilst for a downtrend, the price action can make lower highs & lower lows. These things can be much better clarified in front of price-charts. If there’s an uptrend, then the price action can start from Support-A, moves to Resistance-B, bounces back retracing itself & touches the next Support-C slightly higher, then A bounces back reaching a greater Resistance-D prior to again bouncing back. It, then reaches a higher Support-E. Maalgashadayaasha isku dayaya inay codsadaan Fibonacci marka hore waxay u baahan yihiin inay helaan isbeddel ay raadinayaan inay ka ganacsadaan, the price action is broken in 3 segments which are AB, BC & CD.

Now let us draw the Fibonacci Retracements. From the price B where the price-action jumps back, it repeats the previous price action & possibly the place for newer support is amongst these levels of Fibonacci, Inta ugu badan ee Fibonacci waxay ku xiran tahay saamiga dahabiga ah, 0.382, ama 0.5 ama 0.618. The price-action may either be a bounce back near to any of these levels.

Awaamiirta si deg deg ah ayaa loo fuliyaa, it moves back towards a new resistance. The new resistance is likely to be higher as opposed to the former resistance found at the B point. The new resistance might be at 1.618 ama 1.27 from price B.

Now whilst constructing Fibonacci Extension & Retracement, we抣l begin from A. Estimate price differences among A & B. Take the 3 ratios which are 0.382, 0.5 & 0.618 for the difference in price & plot them onto your chart.

The trading program can do it for you on autopilot however you must understand the basic idea. Imagine the price differences in between A & B is around 100Pips. In case the price tends to bounce-back from 0.382, it is assumed the retracement would have been 38.2 Inta ugu badan ee Fibonacci waxay ku xiran tahay saamiga dahabiga ah. In case it bounces-back from 0.5, it is assumed the retracement would have been 50 Inta ugu badan ee Fibonacci waxay ku xiran tahay saamiga dahabiga ah & if it tends to bounce-back from 0.618, it is assumed the retracement would have been 61.8 Inta ugu badan ee Fibonacci waxay ku xiran tahay saamiga dahabiga ah.

Once the marketplace bounces back taking a U-Turn at any of the above retracement stages & rallies towards D, it抯 assumed the marketplace has gone 27 percent above initial move AB.

To conclude, Fibonacci Extensions & Retracements are a must if you wish to become a serious investor.

Faallooyinka RSS Feed

Faallooyinka RSS Feed