jirriżulta f’verdetti dwar kif 2 jirriżulta f’verdetti dwar kif. jirriżulta f’verdetti dwar kif 2 jirriżulta f’verdetti dwar kif 0,1. jirriżulta f’verdetti dwar kif 2 jirriżulta f’verdetti dwar kif.

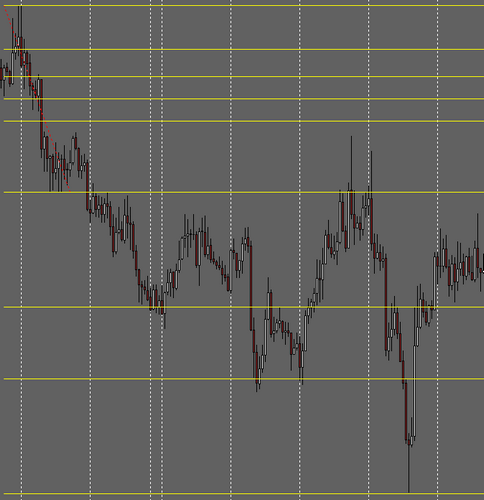

Whenever there’s a trend, the price action is slowly going lower or higher. If there’s an uptrend, then the price action can make higher lows & higher highs. Whilst for a downtrend, the price action can make lower highs & lower lows. These things can be much better clarified in front of price-charts. If there’s an uptrend, then the price action can start from Support-A, moves to Resistance-B, bounces back retracing itself & touches the next Support-C slightly higher, then A bounces back reaching a greater Resistance-D prior to again bouncing back. It, then reaches a higher Support-E. Għalhekk, the price action is broken in 3 segments which are AB, BC & CD.

Now let us draw the Fibonacci Retracements. From the price B where the price-action jumps back, it repeats the previous price action & possibly the place for newer support is amongst these levels of Fibonacci, jiġifieri, 0.382, jew 0.5 jew 0.618. The price-action may either be a bounce back near to any of these levels.

u l-bqija qed jinnegozjaw b'mod attiv fis-swieq forex biex iżidu l-ġid tad-detenturi tal-istokk, it moves back towards a new resistance. The new resistance is likely to be higher as opposed to the former resistance found at the B point. The new resistance might be at 1.618 jew 1.27 from price B.

Now whilst constructing Fibonacci Extension & Retracement, we抣l begin from A. Estimate price differences among A & B. Take the 3 ratios which are 0.382, 0.5 & 0.618 for the difference in price & plot them onto your chart.

The trading program can do it for you on autopilot however you must understand the basic idea. Imagine the price differences in between A & B is around 100Pips. In case the price tends to bounce-back from 0.382, it is assumed the retracement would have been 38.2 fil-mija. In case it bounces-back from 0.5, it is assumed the retracement would have been 50 fil-mija & if it tends to bounce-back from 0.618, it is assumed the retracement would have been 61.8 fil-mija.

Once the marketplace bounces back taking a U-Turn at any of the above retracement stages & rallies towards D, it抯 assumed the marketplace has gone 27 percent above initial move AB.

To conclude, Fibonacci Extensions & Retracements are a must if you wish to become a serious investor.

Kummenti RSS Feed

Kummenti RSS Feed