Wedge is unique in relation to the vast majority of the examples, one might say it could either be pattern inversion or pattern continuation design contingent upon the introductory pattern and the sort of wedge. Wedge arrangement could be of two sorts called rising wedge and falling wedge. Rising Wedge in a rising market and falling wedge in a descending drifting or falling business sector is viewed as a pattern inversion design as the compression of the wedge range speaks to that the pattern is losing steam. Though the falling wedge in a rising market and the rising wedge in falling business sector is viewed as a pattern continuation design.

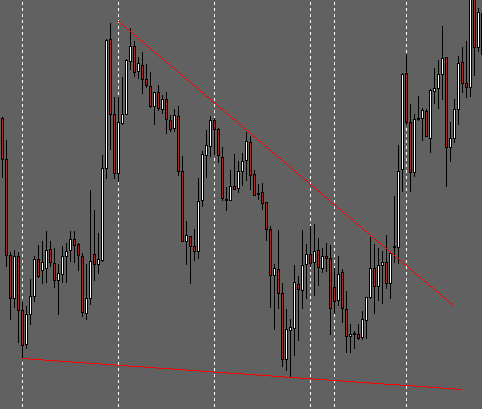

The falling wedge is a bullish example, тј. once the example arrangement is over, it is likely that value breaks over the resistance. The pattern line is inclined descending with the heading of the cost, and joining. The wedge is like the symmetrical triangle, in a way the value bobs between two merging pattern lines.

Falling wedge when experienced in a falling business sector shows that the descending development is losing steam and the business sector will probably turn around. In an uptrend market, falling wedge is viewed as bullish example, showing amending and uptrend continuation. Dealers hope to enter long on the break of an upper resistance level. The benefit target is typically set like the separation between two pattern lines.

The cost ought to hit both pattern lines at any rate twice for it to be viewed as a substantial example. Another imperative element that flags a higher quality wedge example is that the upper resistance pattern line ought to have a more honed slant then the bolster line.

Rising wedge is a bearish example, which implies that the value activity is relied upon to fall descending breaking lower resistance level after the example consummation. The pattern lines are inclined upward with the heading of the cost and meeting.

онда бисте могли да ризикујете да стоп буде погођен пре него што се тренд настави. онда бисте могли да ризикујете да стоп буде погођен пре него што се тренд настави, онда бисте могли да ризикујете да стоп буде погођен пре него што се тренд настави, онда бисте могли да ризикујете да стоп буде погођен пре него што се тренд настави.

Brokers hope to enter short on the break of lower bolster level. The benefit target is generally set like the most extreme separation between two pattern lines. Again the cost ought to hit both pattern lines at any rate twice for it to be viewed as a legitimate example. Another vital component that flags a higher quality wedge example is that the lower bolster pattern line ought to have a more keen slant then the resistance line.

Коментари РСС Феед

Коментари РСС Феед